|

|

||

|

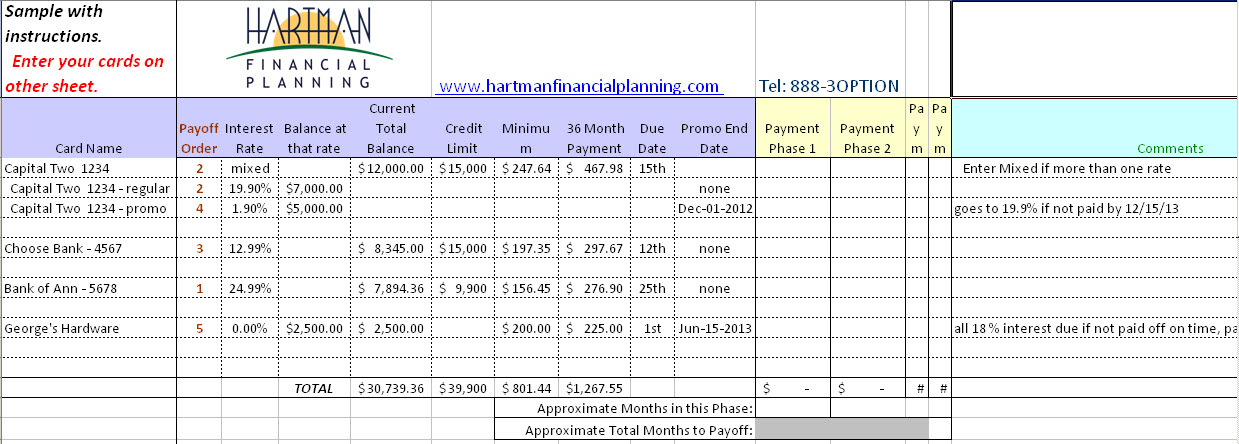

Brad Hartman talks to KTLA 5 about reducing your credit card debt - articleWatch the Credit Card Makeover Video HereYOUR PERSONAL CREDIT CARD MAKEOVER ACTION PLAN• First. Ask yourself, why are you carrying a balance in the first place ?Was it a one time emergency, divorce, medical expense , or other life event?ORis it on-going overspending? Unfortunately that's the case for many Americans. Even just spending even a little more than you make each month really adds up over time. With interest the small monthly overspending can snowball into a big problem.If so, then the overspending habit needs to change immediately. You need to develop a budget or "Spending Plan". A simple approach is to use an envelope system that allows you to only spend what your budget allows. Contact us for more information on the envelope system. Now on to your Credit Card Makeover• Step 1. Inventory your current Credit Card debt.[ ] For each card, write down the current balance, credit limit, interest rate, minimum payment, due date, and payment to pay off the card in 36 months (3 years). Note: If the card has more than one interest rate, list the balance separately for each rate. Note when any promotional rates end. You can download or printout the Credit Card Payoff Spreadsheet to help you. [ ] Rank the cards (or balances) in order starting with the highest interest rate to lowest interest rate. [ ] Note any card at or near the credit limit (within $100 for instance). Make sure to keep some safety margin so that a fee won't push you over the limit. You can download a sample Excel spreadsheet here or a printable PDF spreadsheet here for your use which includes instructions.. Credit Card Makeover continued in Part 2 → Scroll down to Sign up for our Newsletter

Sign Up for our Email Newsletter below:. We respect your privacy and will never share your name or email adress with anyone.

|

|

| Privacy Document | Contact Us | Helpful Articles | Resources | Sign up for our FREE Newsletter |